December 27, 2018:

Save Money on Your Mortgage with These Expert Tips

The average Canadian spends 40 hours a week working hard to ensure they have the money to pay their loans and monthly bills, save for home renovations or family vacations, or even to prepare for their future.

For many, this includes paying a monthly mortgage payment. While you may be tempted to opt for a longer mortgage period in order to pay a smaller monthly amount, it will end up costing you more in the long run.

Following the tips below will help set you up to pay your mortgage off faster and save you significant interest costs in the long-run.

Amortization Period:

An amortization period is the amount of time it takes to pay off your mortgage. The average amortization period is typically around 25 years with the maximum period being 30 years.

Choosing a Shorter Amortization Period:

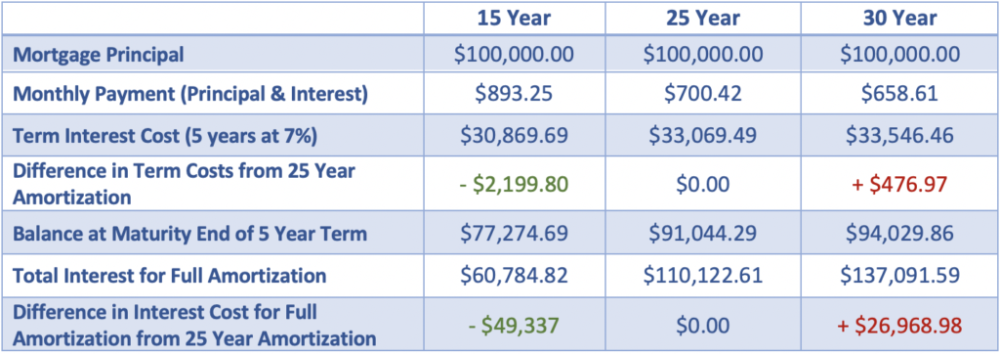

A shorter amortization period means you will be paying higher monthly payments, but it also means that you will pay significantly less interest over the life of your full mortgage. You can choose a shorter period when you set up your mortgage or when your mortgage term is up for renewal.

The chart below shows the comparison of the same $100,000 mortgage and the significant difference of total interest with the mortgage principal being stretched over 15 years, 25 years, and 30 years.

Choosing a Longer Amortization Period:

In order to qualify for a longer amortization, you must make a down payment of at least 20% of the purchase price of the property. The maximum amortization is 30 years. If you choose a longer amortization, you may wish to consider a strategy to reduce the time it will take to pay off your mortgage over the life of your mortgage, as your cash flow allows. RBC Royal Bank’s money saving options, such as Double-Up® payment, accelerated payment, 10% anniversary payment and annual 10% increase in payment amount, can get you on track to an even shorter amortization period.

It is always best to talk to your mortgage specialist to see if these options work for you and what other options you may have based on your specific mortgage.

Payment Frequency

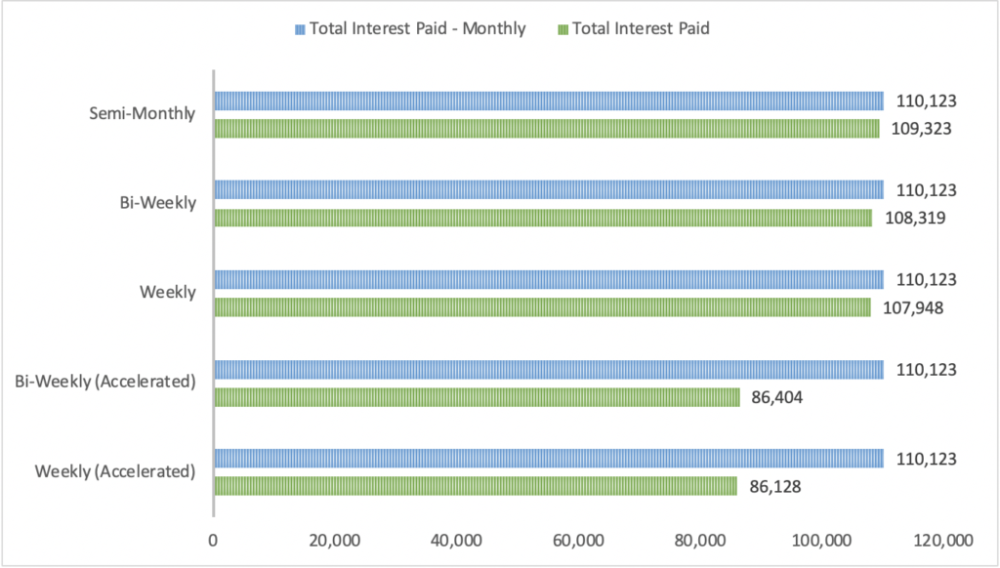

More frequent payments are one of the ways you can pay off a mortgage sooner. You have the choice of weekly, biweekly, semi-monthly or monthly payments. Weekly and biweekly payments can be accelerated, which means that you make a slightly larger payment each time, which amounts to the equivalent of one extra monthly payment a year.

The chart below shows the comparison of the same $100,000 mortgage and the difference of total interest based on the payment frequency.

Double-Up Payments

With a Double-Up payment, your payment goes directly toward reducing the principal balance of your mortgage. You can:

Prepay up to the principal and interest portion of your mortgage payment on any or every payment date

Pay up to the equivalent of your regular monthly mortgage payment, whether it’s weekly, biweekly or monthly

The following example of a $100,000 mortgage at 7% shows how you can dramatically reduce the time it takes to pay off your mortgage simply by doubling up one monthly payment each year.

For example, say you are making monthly payments on a $100,000 mortgage that has a 25 year amortization period. If you were to double up on one of those monthly payments per year, not only would you save $21,469 in interest costs, you would also shorten the amortization period to 20.8 years!

Principal Prepayments

Applying principal prepayments directly to your mortgage principal allows you to:

Prepay up to 10% of the original amount of your mortgage once in every 12-month period

Make a principal prepayment at renewal time for any amount you wish

A principal prepayment of even $2,000 a year can make a sizeable difference in the time it takes to pay off your mortgage.

For example, say you have a $100,000 mortgage that has a 25 year amortization period. If you were to make an annual $2,000 prepayment, not only would you save $43,760 in interest costs, you would also shorten the amortization period to 16 years!

Increase Your Payment Amount

Once every 12 months, you are able to increase the amount of the principal and interest portion of your mortgage payment by as much as 10% without any prepayment charge. The increased amount goes directly towards your principal.

Tips and advice from Nicole Daoust – RBC Mortgage Specialist

705-728-5832 – Office

705-791-6584 – Cell

If you’re looking for an app to save you time and frustration, go straight to the top: Faris Team’s Canadian Mortgage App provides a wide array of tools and tips to help you calculate expected costs, loan borrowing fees, and so much more.

Click here to download the app

For complete information on our Faris Team Canadian Mortgage App, click here.

Stay Connected

Get the latest real estate news, exclusive listings, home evaluations, and promotions in your inbox.

By subscribing you agree to our Terms & Privacy Policy.

You can easily cancel at any time by selecting the unsubscribe option.